Low Maintenance Stocks

What are Low Maintenance Stocks?

Low Maintenance Stocks are stocks that are purchased when Market prices are low, provide a decent rate of return, and do not require constant monitoring.

The best thing about Low Maintenance Stocks is once purchased, you need not worry about them falling out of favor regardless of the state of the economy.

Instead, your focus is on finding and purchasing them!

How To Find Them?

To find Low Maintenance Stocks, identify industries that consistently report profits.

Next, identify industries that appear to be weakening.

Then, seek out the leading companies in both instances. This will be your area of focus in finding Low Maintenance Stocks.

Look closely at these companies. They are industry leaders that are managing operations in a manner that produces profits and allows dividends to be paid.

Most important, these companies are prime candidates for Low Maintenance Stocks!

Narrow Your Results

With prime candidates identified from your initial search, you will need to narrow your results further.

Do so, by seeking answers to the following:

- Which companies reported profits in a weak and strong economic climate? This is an indicator that the state of the economy has minimal impact on a company's ability to produce a profit.

- Which companies paid a dividend and, more important, continued to pay a dividend in a weak and strong economic climate? This is another indicator that the state of the economy has minimal impact on the ability to produce profit to the extent that the company is able to payout dividend and not forced to reinvest them into the business.

Almost There!

Once you have answers to the above, you are almost there, that is...

- You will have found a group of companies that operate at a profit, consistently payout dividends, and are leaders in their industry. Good information to know and keep in your back pocket!

- And, you can now select companies that have an annual yield that supports your financial objective. As a general rule, pick stocks that have an annual yield that exceeds the yield on your checking and/or savings account.

The end result is a pool of Low Maintenance Stocks that you will purchase when the time is right. This will require you to set aside money to invest so you can purchase them at a moment's notice.

"Sidebar"....

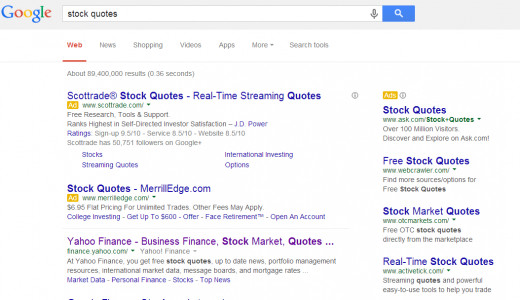

Before going further, it is strongly suggested you find a Stock Quote Search to help you identify Low Maintenance Stocks.

A quick Google Search as shown in the sidebar offers suggested sites that are just a click away!

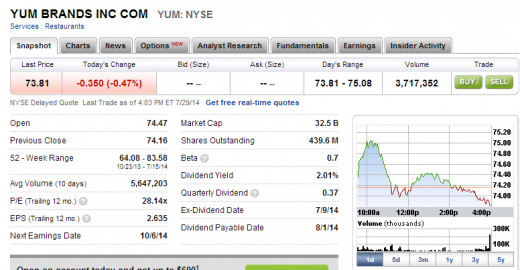

There are many to chose from but at a minimum, the Stock Quote Search should have:

- A Snapshot that provides stock price information to include the day's price, previous closing price, as well as access to historical price information.

- Also, since we are focused on Low Maintenance Stocks, it should also provide Dividend information that shows Yield, Periodicity (Annual, Quarterly), Ex-Dividend Date, and Dividend Payable Date.

- Also, a Company Overview is useful as it's always better to know what a company does to make a profit before investing your hard earned dollars!

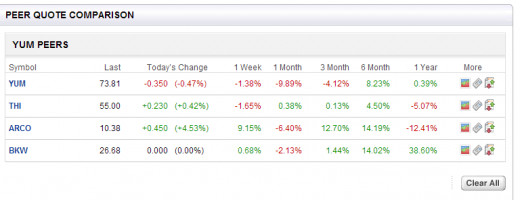

- And, most important, a quick link of Industry Peers is critical to the search of Low Maintenance Stocks. By selecting the link, a quick comparison of an industry is available for your review.

When do you typically buy stocks?

When To Purchase?

As the savvy Investor said, "Buy low and sell high," keep this in mind when you prepare to purchase Low Maintenance Stocks.

Then, watch the Market and listen to the news and stay abreast of current events.

Observe how the Market reacts to good and bad news. Watch how your pool of Low Maintenance Stocks reacts to the same news as well.

In doing so, you will be able to estimate when the stock prices of your Low Maintenance Stocks will be lower than normal; therefore cheaper to buy.

All things equal, given no change in the business, the assumption is the price drop was a result of the Market's reaction to current events and not a change affected by the company.

FYI: As noted by Wikipedia, stocks that pay dividends typically will drop in price on the ex-dividend date.

SUGGESTIONS....

Here are three suggestions for Low Maintenance Stocks - YUM, WEN, WDFC.

Although not a recommendation to buy, use them as a starting point in your research.

Do check the historical prices in the graphs below and note the stocks were purchased October 19, 2009!

Two did well, a third did not do as well but still did better than a checking/savings account and has begun to trend in the right direction in 2014!

Bottom-Line

Low Maintenance Stocks provide a sense of security by recognizing companies whose past performance and ability to weather good and bad economic climates will continue in the future.

Although there is a risk when investing in any stock, you are reassured that your money has been invested wisely in strong companies that are industry leaders, who consistently produce profits and payout dividends.

YUM

Bought at $34.10 in October 19, 2009. Closed at ~ $70 in late July 2014, going as high as the $80, too!

This one has paid dividends without a break since purchased, even better, it's several companies in one!

Think Pizza Hut, Kentucky Fried Chicken, and Taco Bell. A&W was in the mix briefly but the company scaled back to it's core three once again.

Good times, bad times, inflation, recession... this group continues to profit!

WEN

Bought at $4.34 in October 19, 2009. Hovering around the $8.00 mark in late July 2014, and going as high as $9.00+ earlier in 2014!

Cannot pick them all, but even then, having picked a solid company, a good return on investment was had with this one.

Although a rough patch was had for several years which included Wendy's attempt to branch out with Arby's, the end result is a profit with no additional "maintenance" other than the initial purchase!

WDFC

Bought at $34.30 in 2009 (October 19, too), at the $68.00 mark in late July 2014, and hitting the $79+ in the last 52 weeks.

This one has been paying dividends for decades without a glitch! Even better, over 90% of households and 80% of manufacturers use its products... WD-40 and 3-In-One Oil!

Yes, there are issues with recent legislation in its home state of California regarding its sale. No worries, eventually companies that over-taxed and over-regulated tend to leave states for more business "savvy" states.

Still own this stock, no plans to sell it, still making a profit with no more effort than the initial purchase!